News

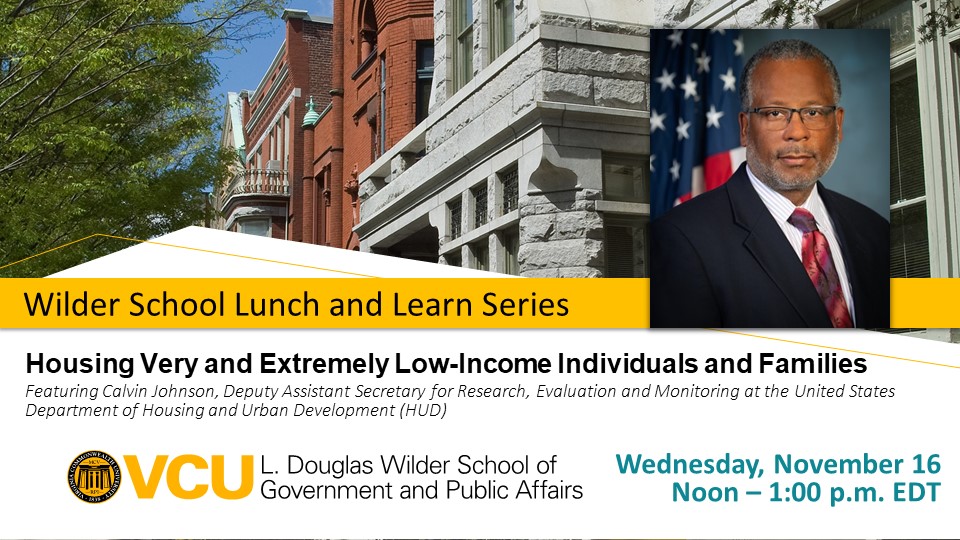

Housing very- and extremely low-income individuals and families with Calvin C. Johnson

In this presentation, Calvin C. Johnson, Ph.D., Deputy Assistant Secretary for Research, Evaluation and Monitoring, Office of Policy Development and Research (PD&R) at the U.S. Department of Housing and Urban Development (HUD) described patterns of worst-case housing needs, sharing why HUD’s major rental assistance programs are a safety net for only a fraction of extremely- and very low-income renters. He highlighted patterns of homelessness that are inextricably tied to worst-case housing needs and a lack of more extensive rental assistance program resources.

Making sense of rental trends

Johnson’s presentation referenced Harvard’s Joint Center for Housing Studies Report: America’s Rental Housing 2022 Release, which reveals a rapidly changing rental housing market over the past decade.

“Folks are moving into homeownership later,” said Johnson. “That means that renters are staying renters longer. and it means that there are more higher-income renters.”

Prior to 2010, the majority of renter growth was driven by low-income households, but today these have actually declined. The data reveals that higher-income renters have shot up by 48% in the past decade. Compounding this, said Johnson, is growing inflation and he forecasts that the trend in increased rental housing for higher income brackets will continue.

One positive he shared is that housing construction sits at a three-decade high, with strong focuses on multi-family properties. But across the nation, a majority of this new construction and renovations are targeted at high-income renters. As the supply of low-income housing continues to decline. Some states like Colorado, Nevada and Texas have seen nearly a 50% decrease in low rent supply.

Bolstering a failing social net

As families spend more and more of their income on housing costs, many social safety nets are no longer extensive enough to support renters needs. Johnson defined worst-case housing as renters with incomes at or below 50% of the area median income who pay more than 50% of their income to housing costs. Often these renters live in severally inadequate conditions.

According to the American Housing Survey, conducted by the U.S. Census Bureau, people experiencing homelessness are not included in the survey count of worst-case housing needs, which only extends to housing units and their households. According to the 2019 survey data, 7.7 million Americans are classified as very low-income, paying more than half their income wages toward housing.

Census Bureau data only surveys current renter households, which creates a tremendous gap in recognizing the true number of Americans in need of rental housing support.

Native American, Black and Asian renters experience disproportionate rates of worst-case housing, with Black households experiencing more than twice that of white households. Rent-burdened households also spend 35% less on food, 46% less on clothes and 70%-74% less on healthcare.

“It is critical to address the problem now,” Johnson said. “Over the past 20 years, the unmet need for decent, safe and affordable housing has continued to outpace both income growth and the ability of government to supply housing assistance.”

Because of these growing burdens, Housing and Urban Development rental assistance is only available to around 20-25% of those in need and approximately 2.5 million applicants are currently waitlisted. These applicants face wait times of around 21-28 months.

Improving services with a focus on social equity

For Johnson, there are many potential solutions to improve access to support low-income renters. He cited the need to reduce regulatory barriers, which can harm the production of low-cost housing. Preserving existing low-income housing is another critical priority.

“We have large numbers of people of color and those neighborhoods are transitioning, turning over, and you see slowly and over time, more high-income renters moving in,” said Johnson.

He highlighted the need to expand programs that incentivize structural renovation grants, which can help preserve existing housing and stave off patterns of gentrification.

Partnering with planners and engineers is another strategy to reduce new build costs. Johnson also sees value in extending programs that specifically focus on raising black homeownership rates and grant support for student renters.

"I think the other thing that we should note for our audience is that HUD does have an equity action plan that really speaks to eliminating racial gaps at home ownership,” Johnson said.